Post COVID-19: Post Pandemic Consumer Behavior

It was an amazing privilege to have a conversation with Martin Moodie on the topic of consumer behaviour in support of the Moodie Davitt podcast series In Crisis – Travel Retail Voices.

To address the topic of post-pandemic consumer behaviour it is imperative to understand the last connecting point so that the line from A to B has purpose and context regardless of industry.

As recently as three months ago travel retail was still proving to be a darling of the retail world for many reasons that a customer will reference when they return to the shop floor. With a historic growth trend that far outperforms the local market, travel retail has survived world events such as 9/11, pandemics, geopolitical events and MAX 8 disasters. Retailers, brands and staff were placing their futures on the continued growth and resiliency of this sector.

Pre-crisis Consumer behaviour was indicating a strong omnichannel trend. The sales approach in travel retail was outpaced by the buying behaviour of the customer. Purchase decisions that rested on the best price increasingly diminished the competitiveness of travel retail. The notion that ‘duty-free equals a better price’ was eroding. More regular and more robust sales training was required before the pandemic began.

Consumer behaviour post-crisis will further emphasize this trend. The market has moved, the pandemic has compounded the urgency to meet the customer where they are at. Pre-crisis fifty percent of customers were referencing online prices while making an in-person buying decision. The pandemic has grown the online channels by approximately 27% with delivery services not being able to keep up with demand.

The sales approach on the shop floor will require a readiness to manage customer objections and changed attitudes. The consumer demographic is globalized and engaged with a brand in the local market, online through e-commerce, and airside in travel retail. The expectation is for most seamless and consistent brand experience across all channels, at all times, and in all locations. The customer has most likely shopped the brand in the local market before departure, may very well be shopping or browsing online on the way to the airport, and reconnecting with the brand in duty-free. This customer is ready for an in-person experience and the more the sales approach can integrate the omnichannel behaviour, the stronger the brand experience and the more brand loyal the customer will be.

Post COVID-19 we will be in a world that is less about competing channels and more about complementary channels. Quite simply put, travel retail will need to highlight and invest into the aspects unique to travel retail. An emphasis on differentiation and privilege will encourage the uniqueness of travel retail. As a complement to e-commerce, the airport experience must build on the fundamentals of delight and exclusivity and brand promise. The consumer will be expecting a gentler, softer approach that is more loyalty focused. There is likely pent up demand in terms of spending and in terms of browsing in person. We will be training our team to anticipate a customer that is cautious yet happy to be in a store again. Travel retail benefits from the added dimension of scarcity. “If I don’t buy this now, I may regret it and I will need a valid boarding pass to be back in this store”. All planning for travel retail needs to be built on the assumption that the customer is cautious yet ready to engage.

Travellers who do not feel safe post-COVID-19 will likely not browse and proceed straight to the gate. It can be assumed that the customers in the store are the ones who feel safe enough to be there and willing to engage with sales staff who are supportive and excellent at reading a customer.

The pronounced shift to e-commerce during the crisis will accentuate the benefits of the omnichannel accessibility to products. The customer will be satisfied and accommodated on the one hand, on the other hand, they will have high expectations around the in-store sensory and educational experiences. Travel retail as a differentiator sets the stage for brands to shine. The more brands can influence who is representing their product, the better. The right skills will yield a positive ROI in the immediate term and support lifetime loyalty over the long term. Conversely, a detrimental interaction with the brand will be more costly than in the past as the customer’s senses are heightened and experiences good and bad will be more pronounced.

Competitiveness and attractiveness of travel retail will continue to benefit from travel exclusives in terms of product mix, promotion and customer experience. The investment into these priorities has helped shape the popularity of travel retail over the past many years with revenue growth that far outpaced the domestic market. The future holds increased expectations. The traveller has become sophisticated, globalized and well served through years of a customer-first philosophy.

The post-pandemic customer sensitivities will take this expectation to another level and with heightened expectations that include health and safety measures. Guidelines for social distancing and new requirements for physical infrastructure is still forthcoming. Not only is our customer different and our sales staff different, but also our spaces will be very different. As of April 20th, CANADA has mandated face masks for travellers post-security. How beauty products can be best presented, tested, advised in a post-crisis sales model will most definitely depend on the support and skill and sophistication offered to the front-line staff.

Liquor and Confectionary activations may very well require single-serve and individually packaged samples. Training, supplies and retail floor support for Brand Ambassadors will be required around all activation details. Customers will still expect a brand positive moment that is inspired, engaging and compelling. The brand ambassador will become more effective in one on one interactions and likely require more time on the conversion. The KPIs for Brand Ambassadors will likely reflect fewer customer connections per hour, lower average sales per hour and lower conversion rates. The performance expectations for Brand Ambassadors need to support the targeted ROI and activation objectives both qualitatively and quantitatively.

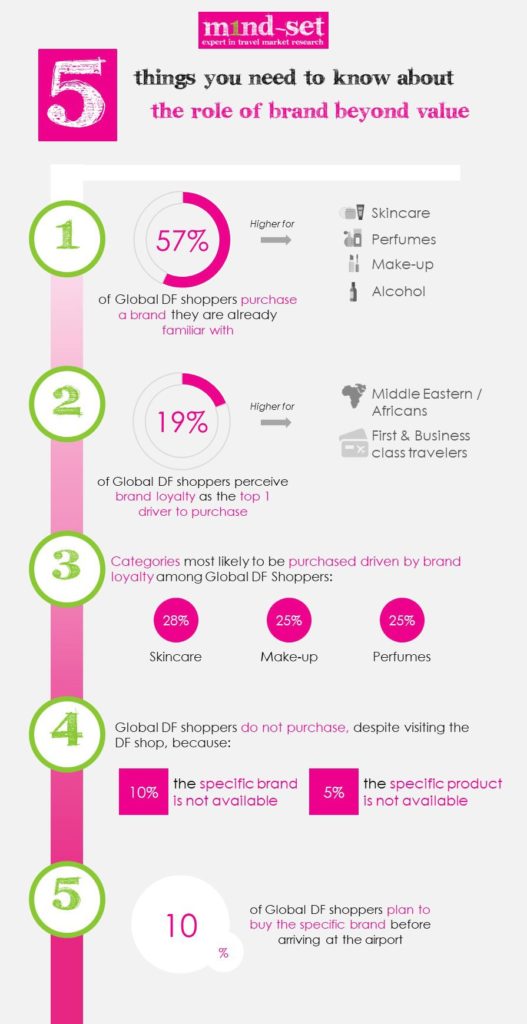

m1nd Set travel retail research highlights the 5 Things to Know about brand beyond value are:

The industry seems innately wired to recover. While we do not know the timeline, we can be confident that the consumer still has many reasons to cherish airport shopping. In addition, airport authorities have a vested interest in supporting retail as an essential source of revenue for capital projects and for lowering travel costs. The industry has solid fundamentals in place including great retailers, the partnering of global brands and the best of talent. There is not a place I would rather be than with a group that rallies to defend this, our wonderful workplace.

Author:

Heidi Van Roon M.B.A. CPHR SHRM-SCP

Founder & President for the SPARK Group of Companies

Heidi gives voice and leadership to Sales and HR excellence for Luxury Retail. Her no-nonsense approach has proven savvy, effective and genuine. Heidi combines an analytical, practical and caring approach that is focused on connecting customers with brands that they love and in a way that digital can’t. Heidi’s leadership style is founded on well-informed context, courageous and creative collaborations, bespoke promotional programs, and genuine heart. SPARK has been named North America’s most professional and highest performing sales team by some of the world’s most prominent luxury brands.

CleanCo Campaign Success

Great coverage by Mark Lane of the Moodie Davitt Report about our participation in a campaign for emerging UK no/lo spirit brand CleanCo in United Airlines Club lounges across four US airports. What an amazing team. It was an

Fragrance Beauty Advisor – English / Mandarin PT

We always enjoy recruiting through our network. Perhaps you or someone you know is interested in a temporary fragrance Beauty Advisor position at WDF YVR from April 3rd to June 7th. This opportunity is suited for someone with beauty/fragrance

2022 Summit of the Americas

Join SPARK at the 2022 Summit of the Americas. The Summit of the Americas is the International Association of Airport and Duty Free Stores annual show and will return as an in-person event! The International Association of Airport Duty

Recent Posts

Alignment between industry and community in HR

Last month, SPARK was featured in Duty Free News International discussing the current state of affairs of the travel retail industry and our goals to put ESG priorities first. Please check out the article

A powerful and poignant contribution to Travel Retail United humanitarian fund for Ukraine

For a cause that is so near and dear to SPARK, we wanted to share coverage by The Moodie Davitt report on our recent donation to the Travel Retail United*, the humanitarian fundraising project

CleanCo Campaign Success

Great coverage by Mark Lane of the Moodie Davitt Report about our participation in a campaign for emerging UK no/lo spirit brand CleanCo in United Airlines Club lounges across four US airports. What an

Fragrance Beauty Advisor – English / Mandarin PT

We always enjoy recruiting through our network. Perhaps you or someone you know is interested in a temporary fragrance Beauty Advisor position at WDF YVR from April 3rd to June 7th. This opportunity is

2022 Summit of the Americas

Join SPARK at the 2022 Summit of the Americas. The Summit of the Americas is the International Association of Airport and Duty Free Stores annual show and will return as an in-person event! The

Ready for a Sales & Marketing challenge in US airports?

New Opportunities in Travel Retail! Are you ready for a Sales & Marketing challenge in US airports? SPARK is pleased to promote these exciting positions in Travel Retail at the following locations: Sales Promoter

Join SPARK at the Virtual Travel Retail Expo October 11-15

The Virtual Travel Retail Expo is a pioneering virtual trade show and symposium designed to both mirror and enhance a real conference and exhibition. Entering its second year, the expo has already established itself

Virtual Summit of the Americas Summary

Virtual Summit of the Americas Summary For a comprehensive recap of the Virtual Summit of the Americas, grab a coffee and a comfy chair and get ready to scroll in every direction. Here are some of our favourite sessions that

SPARK at the Virtual Summit of Americas

SPARK at the Virtual SUMMIT OF AMERICAS While our current team of staff is the smallest it has been in nine years, we are hugely encouraged by the industry recognition in the past year. Among

If ever there was a time to collaborate and align our strengths, it is now.

“If ever there was a time to collaborate and align our strengths, it is now” – SPARK President Heidi Van Roon sounds rallying call ahead of Summit of the Americas by Martin Moodie martin@moodiedavittreport.com

Turning a Page in the History Books

“Turning a page in the history books” – Heidi Van Roon on elevating the sales profession to a new level By Colleen Morgan Colleen@moodiedavittreport.com Source: ©The Moodie Davitt Report 30 March 2021 “The time

Sparking a New Airport Retail Staffing Solution for Maximising Sales

Heidi Van Roon on sparking a new airport retail staffing solution for maximizing sales By Mark Lane: mark@moodiedavittreport.com Source: ©The Moodie Davitt Report 18 March 2021 Spark Group of Companies has unveiled a bold

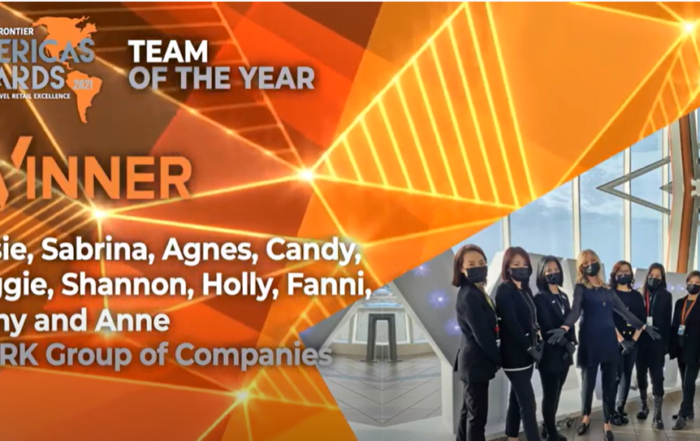

SPARK shortlisted for the 2021 DFNI Americas Awards Team of the Year

We are delighted to announce that SPARK has been shortlisted for the 2021 DFNI Americas Awards Team of the Year category. Jessie, Sabrina, Agnes, Candy, Maggie, Shannon, Holly, Fanni, Jenny and Anne have all been selected

The New Brand Partner Program

Brand Partner Program We are pleased to introduce the Brand Partner Program which is quickly gaining attention on social media and in the Travel Retail publications serving North America. This program essentially morphs the typical Brand

Virtual Summit of the Americas

How can the Travel Retail Industry begin to recover from the most complex crisis in history? These and many other questions will be covered at the upcoming Virtual Summit of the Americas from April 5-9, 2021.

Stars of 2020

Coverage from the Moodie Davitt Report: Stars of 2020: Heidi Van Roon’s retail heroines Spark hope amid the gloom of COVID-19: Continuing our Stars of 2020 series, we see how the brand ambassadors trained for airport retail by the SPARK Group of Companies and their leader have kept smiling behind the mask, in this most challenging of years.

Brands and Retail Theatre: A Bigger or Lesser Choice?

Watch the webinar hosted by Peter Marshall, TRUnblocked and our own Heidi Van Roon discuss airport and travel retail.

Adapting The Front Line Team for the Retail Revolution

The roles of all customer-facing staff have become more important than ever. Market shifts that once spanned a decade have happened in six short months. The retail industry, and particularly luxury travel retail is undergoing an unprecedented revolution and we are at the very beginning of it. It is a time for retailers and brands to adapt to every customer-facing function. With retailers restructuring, the onus will be on brands to ensure a people-positive experience for their customers.

Future Airports: From Here to Where?

Portland Design, together with the influential travel retail blog trunblocked.com are launching a webinar series – Future Airports: From Here to Where? – to be staged on the 16th September 2020. This event will bring together a remarkable

Purple Cow: Remarkable Brand Power

This month, our very own Heidi Van Roon, Founder & President, the SPARK Group of Companies, is featured on Trunblocked, talking Brand Empowerment.

Airport Update – August 2020

Airport Update – August 2020 Capital investments and airport infrastructure improvements provide vital context for the development of the Travel Retail industry. Airports have come to depend on non-aeronautical revenues and in many cases,

August 2020 Travel Retail Market Update

It is a pleasure to bring you a collection of Canada and USA Travel Retail insights. As our precious industry deals with this unprecedented crisis, we hope the collection informs some of the recovery

June 2020 Travel Retail Market Update

Among the silver linings throughout this industry crisis is the proliferation of excellent publications, it is encouraging to see information sharing from the experts. While aviation has dropped to historically low levels, the industry pulse among passionate leaders continues strong and healthy.

Embracing The Challenge Against The Odds

Here we are, amid an industry crisis that is encountering unprecedented headwinds. In a few short months, the industry has experienced a setback that could not have been anticipated in degree and in kind. Metaphorically speaking, the headwinds are so strong, we need to pedal downhill just to stay on the bike and in the game. Physically, emotionally, socially, and professionally seemingly unsurmountable challenges loom large. Exhaustion, hunger, pain and delays will take their toll.

The Road to Recovery – Virtual Travel Retail Expo

Throughout the live 5-day Virtual Travel Retail Expo 2020, the Symposium Hall and Workshop Rooms will host industry dialogue around the theme ‘Road to Recovery’, exploring how the travel retail channel will (or should) look in the future. The powerful line-up of speakers includes our very own Heidi Van Roon.

Airport Update – June 2020

Airport Update - June 2020 For an interactive Coronavirus Travel Restrictions Map – bookmark this amazing IATA link to see the country by country travel restrictions: In our March Market Update, we included a

How can we accelerate Travel Retail’s recovery?

The rebound of the travel retail industry will need to quickly embrace the increased customer expectation of a seamless, omnichannel experience where the customer determines how they interact with the brand.

SPARK Careers in Travel Retail Virtual Information Session

Travel Retail offers diverse and dynamic career paths in the duty-free areas of airport terminals, cruise ships and international border shops where global retailers and global brands depend on aspiring professionals. SPARK is committed to

Moodie Davitt Virtual Travel Retail Expo

Moodie Davitt Virtual Travel Retail Expo We are happy to announce our participation at the inaugural Moodie Davitt Virtual Travel Retail Expo. The Expo – which takes the form of a ‘live’ 5-day event followed

Airport Update – May 2020

Airport Update - May 2020 With substantial support from the government, most Canadians whose employment is affected by COVID-19 are supported through various initiatives for a lay-off period of up to 16 weeks. We are

Post COVID-19: The Trinity Initiative

A great example of bright minds and voices converging preparing for the post-COVID-19 recovery is the Trinity Initiative. This collaboration is an invitation for airports, retailers and brands to join in a conversation about the new commercial model.

Post COVID-19: The Rebound

On the demand side, the rebound will depend on the economy and customer confidence. Like a drastic plot change, the commercial model is shifting overnight. We are on that first page of a new chapter. What an amazing opportunity that history would award this writing to the members of the industry today.

Post COVID-19: Staff Fundamentals

Investments supporting the people's assets of an organization are the surest guarantee of continued innovation, creativity and newfound success.

Post COVID-19 Consumer Behaviour

To address the topic of post-pandemic consumer behaviour it is imperative to understand the last connecting point so that the line from A to B has purpose and context regardless of industry

May 2020 Travel Retail Market Update

May 2020 Travel Retail Market Update Amid the current COVID-19 crisis we are all the more committed to standing with our peers and advocating for our workplaces by sharing another collection of Market insights. With

Travel Retail Voices – Heidi Van Roon

In Crisis - Travel Retail Voices is a podcast series by The Moodie Davitt Report, one of the UK’s most successful multi-media business-to-business publishers and an indispensable source of reliable and real-time business intelligence on

COVID-19 Summary of Support from the Canadian Government

In light of the current pandemic, I thought to sketch a basic overview of the Government of Canada initiatives for Employees and Employers that are in non-unionized settings. I have also calculated a basic comparison

March 2020 Travel Retail Market Update

March 2020 Travel Retail Market Update We stand with you as our industry is brought to its knees. Who could have anticipated the extent of our global crisis and the extenuating impact on travel retail?

A Word from Our Founder and President

There’s one thing you need to know about me: I love sales and I love people. What motivates me—what motivates everybody at SPARK —is discovering how an exceptional sales organization can create win-win-win outcomes for staff, retailers, brands and customers.